Managing Multi-Asset Portfolios & Navigating Recent Headlines

2026 to date has seen a spike in negative headlines. With this in mind, we asked our Chief Investment Strategist Patrick O'Donnell to provide some colour into how the team are approaching the increased uncertainty.

Venezuela / Iran

The key point to highlight is that there has been, and continues to be, limited impact on broader markets beyond Venezuela-specific assets, which are trading at severely distressed levels. While the operation was audacious, it has raised concerns that similar actions could be undertaken elsewhere, notably in countries such as Colombia and Cuba, and particularly Iran. Any operation involving Iran would likely have a more material and sustained impact on global energy supplies, potentially pushing oil prices higher. This risk has already begun to be priced into the oil market, with an increased geopolitical risk premium contributing to Brent Crude oil prices rising by approximately 11% year-to-date.

US Tariff threats on EU

Tariffs never truly went away, but since May last year markets have largely operated under the assumption that we had passed peak tariff uncertainty. That may still prove to be the case; however, the fact that tariffs have been brought back onto the agenda has reintroduced an element of risk. Even following Trump’s climbdown at the World Economic Forum, there has been renewed discussion around the potential imposition of 100% tariffs on Canadian imports should Canada agree a trade deal with China. We are also still awaiting a Supreme Court ruling on the use of the IEEPA mechanism. Regardless of the outcome, it is clear that tariffs remain a weapon that the US administration is willing to use. That said, as is often the case with this administration, the situation remains fluid, and for now this does not translate into anything materially disruptive for markets.

Market Concentration in the US

History suggests that when market leadership becomes this concentrated within a single sector or theme, outcomes tend not to end well once we see a shift in the narrative. We saw this during the Nifty Fifty era of the 1970s (dominated by 50 blue-chip US companies), the energy boom of the same decade, technology stocks ahead of the 2000 dot com crash, and financials prior to the 2008 global financial crisis.

Whilst timing any change in narrative is notoriously difficult, we believe the current risk profile is asymmetrically skewed to the downside. Today, the top 10 US companies account for more than 40% of total market capitalisation, while US-listed companies represent over 60% of MSCI ACWI market cap — levels of concentration that leave markets increasingly vulnerable should sentiment shift. In response, we have reduced S&P 500 exposure and diversified into US Small Caps, US Health Care, US Energy and a range of global government bonds.

Japanese Currency Movements

The Japanese yen has been depreciating for the past 12 months; in fact, the trend has been in place since COVID. In isolation, yen weakness is not necessarily problematic. However, when it begins to cause volatility in other Japanese assets, particularly the bond market, policymakers (whether at the Ministry of Finance or the Bank of Japan) typically move to lean against it. This usually starts with verbal intervention, which we have seen from time to time, but on Friday, 23 January, we witnessed a further escalation, with the US Treasury phoning major financial institutions to ask about the yen exchange rate. This unusual behaviour sparked a rally in the yen, as traders took this as an indicator that the US Treasury was preparing to support Japanese officials in propping up the yen.

This matters because currency markets are inherently relative, i.e. one currency increases relative to another. The flip side of yen strength is US dollar weakness. Should recent developments lead to a more persistent decline in the US dollar, the implications for global asset markets could be significant. On Wednesday, US Treasury Secretary Scott Bessent unequivocally denied that the US would step into the currency market to support the Japanese yen, which saw a relief rally in the US dollar. Notably, while US equities delivered positive returns last year, they underperformed rest of world equities as the US dollar weakened.

US Desire to Control Greenland

Under the current 1951 Defence Agreement (the foundation of US presence in Greenland), the US is allowed to operate military bases in Greenland, so President Trump's demands to control Greenland seem rather unnecessary. The subsequent climbdown from President Trump several days later only adds to the confusion. It has been clear for some time (as ice sheets have reduced) that the arctic is very important from a geostrategic perspective. It is opening as a possible sea route for longer periods of time; there are vast natural resources there, and it is crucial for missile detection and has shorter missile trajectories. At this stage, there is no direct impact to global markets, other than through increased uncertainty, but the situation is unprecedented and the potential ramifications to US/EU relations could be extreme.

Conclusion

- Market participants are currently processing a wide range of developments.

- Many of these developments remain fluid and may continue to evolve – we have been worried about the technology concentration in the US and over the last few months have been making changes to manage this risk, e.g. increasing exposure to other sectors in the US (such as Health Care), and adding more exposure to smaller companies in the US.

- Against these developments, our existing positioning (such as investing in the US Energy sector) may help mitigate some risk.

- We continuously and proactively monitor market risks and in our discretionary portfolios (OMPS and Omnis Agility) we will make changes when required.

- Through the active management of our portfolios, we help investors preserve and grow their wealth over the long-term, but it’s important we don’t speculatively react to market news and take a more considered approach.

Can You Time It For Success?

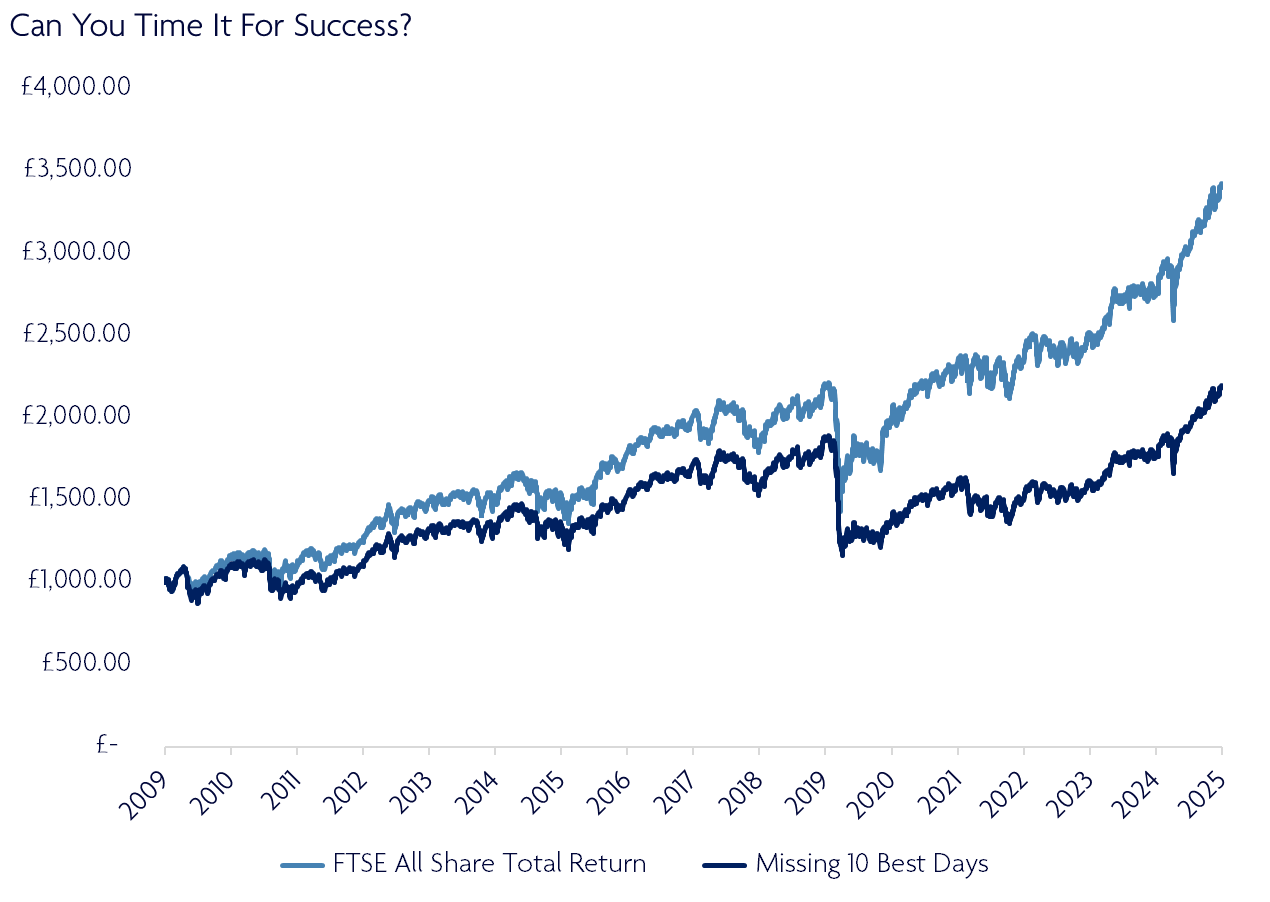

The commentary above feeds into the following chart.

Reacting to negative headlines and trying to time the peak of the market is often a futile exercise. Recent market movements illustrate this perfectly - global equity markets have continued to rally despite what sometimes feels like endless negative headlines.

The chart below highlights that missing the best 10 days can be extremely costly over the long-term. Staying invested, retaining a long-term view and allowing the power of compounding returns to work its magic is what we at Omnis believe is the optimal strategy to assist you in achieving your financial objectives.

Source: Bloomberg; FTSE All Share Total Return