Why We Like Bonds

And why we don't expect them to demise! *

Author: Tim Dingemans, Investment Strategist

The World of Government Bonds

The world of government bonds is, for many, something of a closed book. Terms like “yield to maturity,” “basis points,” and “duration” are used regularly, yet for many they might as well be ancient cuneiform symbols.

At its simplest, a government bond (or “gilt” in UK terminology) is essentially an IOU from the government to you, the buyer. You lend the government £1,000 for a fixed period, and in return it promises to repay the £1,000 plus a predetermined amount of interest. It is the fixed length of the loan and its predetermined interest rate that give rise to much of the confusing terminology surrounding bonds. Ultimately, these terms are all designed to help investors assess whether lending to the government represents a good investment.

Lending to the government has one key advantage. You are likely to get repaid; unlike an equity, in developed market government bonds, there is minimal risk of default (or failure to repay debts). The real risk is what inflation does to the value of that money when you are repaid.

Basically, when you buy a bond, you know exactly what return (the initial loan and interest paid) you will get back. What you don’t know is what the inflation rate will be over the life of the loan, and therefore what the real return (your return after adjusting for inflation) will be from holding the bond. Should you wish to get your money back sooner than the original agreed date (maturity), the vagaries of inflation and government fiscal policy will all come to bear on your return.

Generally, in a high inflation environment, investors demand higher rates of interest (coupons) from the government, whilst accepting lower rates when inflation is lower. Over times this adjustment can get quite extreme, offering opportunities and pitfalls.

In the early 1980s, inflation in the UK and US was very high leading to yields close to 20%. Here investors were so uncertain that the government would be able to control prices (wage demands, oil prices) that governments could only borrow at prohibitive rates and costs. Remember that at an interest rate just over 7%, the size of your borrowing is doubling every 10 years. Investors who bought bonds yielding around 16% were ultimately handsomely rewarded, earning almost five times their original investment over ten years.

More recently (2019/2020), interest rates turned negative in Switzerland, were effectively zero in Germany, and only just above zero in the UK. In this environment, the situation was effectively reversed: the government could borrow almost for “free,” while investors assumed all the risk that interest rates might rise in the future. Many investors learned the hard way that lending money for a very long period at a very low interest rate is rarely a good idea. Austria, for example, issued a 100‑year bond at effectively zero interest during this period, and its price subsequently fell to around one‑third of its original value over the following few years, as interest rates jumped.

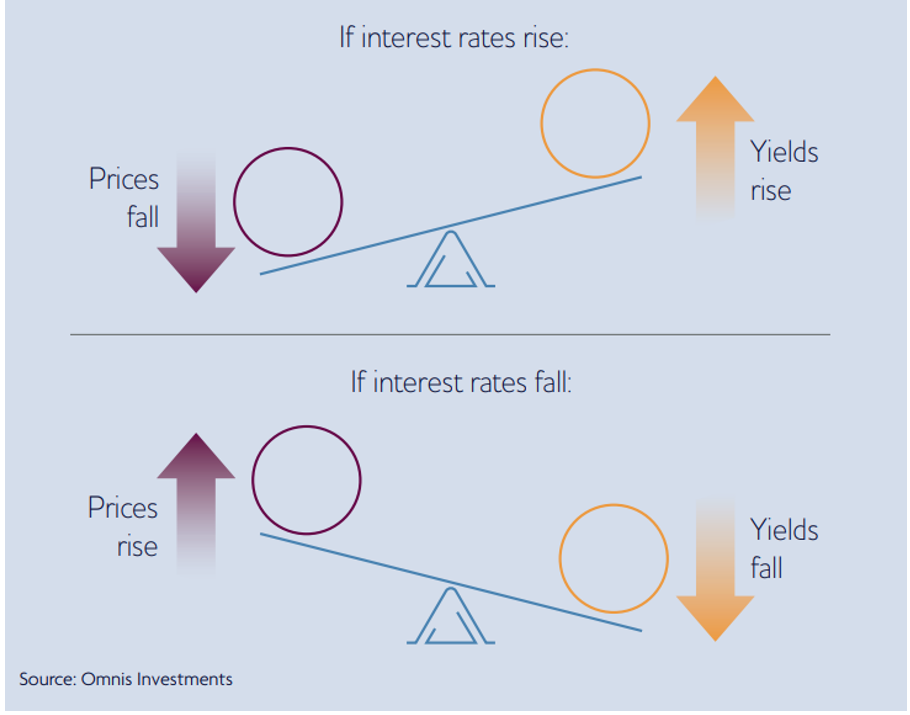

Figure 1. Interest Rates and Bond Yields

Ultimately, when investing in government bonds, terms like yield to maturity, basis points and duration genuinely matter. These factors can meaningfully influence returns and risks, which is why having an investment team that can evaluate when it’s appropriate to increase, hold or decrease exposure to this asset class is so important.

Government Bonds as an Investment Opportunity

I will now endeavour to explain why we believe government bonds once again represent a compelling investment opportunity.

Compounding is allegedly Einstein’s 8th wonder of the world. In essence, as you reinvest the return on your money, the overall value of your invested funds can grow quickly. As I mentioned earlier, at an annual return of approximately 7.3%, your investment doubles over 10 years.

The good news is that several developed bond markets are now offering attractive returns, as well being in a domestic environment where inflation is relatively low and expected to remain stable or even drift lower. For example, 10-year bond yields in the USA are 4.27% and inflation is 2.7%, in the UK 10-year yields are 4.43% and inflation is 3.4%, whilst in France the 10-year is 3.52% and local inflation is 0.70% and Eurozone is 1.9% (all data as of 21 January 2026).

The bottom line is apart from Germany, where there is huge fiscal stimulus (that will keep borrowing rates higher), and Japan where the era of zero interest rates has ended (and potentially yields are now reaching a level where investing makes sense), developed market bonds are offering reasonable returns and diversification benefits to equities.

We are currently increasing our investment in the US, UK and French bond markets, looking to take advantage of the investment opportunity and the diversification benefits they offer. We like the compounding effect of the guaranteed coupon return and the diversification value that bonds offer, when so many other asset classes appear overvalued. Even with the most recent uptick in bond yields, the broader attractiveness of the bonds remains and at the margin has improved. Short of an equivalent of a “Liz Truss Moment” in bond markets, we expect to be adding to bond holdings over the year.

* Apologies to Ian Flemming. "Do you expect me to talk? No, Mr. Bond. I expect you to die!", Goldfinger to James Bond in the 1964 film Goldfinger.

Tim Dingemans, Investment Strategist

Tim Dingemans joined the Omnis Investment Team in 2025. Tim is a Financial Services professional with over 40 years of experience in Portfolio Management, Personal Financial Services, Fintech, and Investment Banking sales. Tim has worked as a Portfolio Manager for over 10 years in global macro and Emerging Market hedge funds. Tim spent 20 years in Investment Banking working for UBS, ING and Morgan Stanley. More recently, he has worked in the IFA world as CIO and helping bring Fintech into IFAs. At Omnis Investments, Tim uses his experience across the Advice world, Investment Banking and Portfolio Management to help the Investment Team achieve superior investment outcomes for our client portfolios.

www.omnisinvestments.com

Issued by Omnis Investments Limited. This update reflects the views of Omnis at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. Past performance should not be considered as a guide to future performance. The value of investments and any income from them may go down as well as up and cannot be guaranteed. Prospective investors are reminded to read the fund's Key Investor Information Document and Prospectus prior to investment. These are available free of charge from Omnis Investments Limited. Omnis Investments Limited is authorised and regulated by the Financial Conduct Authority.