Navigating AI-Induced Market Concentration

As the Artificial Intelligence (or AI) narrative continues to dominate market discussions, investor sentiment has become increasingly divided.

While the long‑term transformative potential of AI is widely acknowledged, questions are growing around valuations, the scale of capital investment required, and the sustainability of the market’s current narrow leadership. Against this backdrop, we’ve gathered perspectives from the Omnis US Equity Leaders Fund manager, T. Rowe Price, alongside views from the manager of the Omnis Managed Funds, Schroders, as well as our own Omnis Investment Team.

Across these three viewpoints, there is a shared conviction in AI’s structural growth potential, but also recognition that the path forward is becoming more complex. Each team offers a different lens on how to navigate the widening dispersion in fundamentals, valuations and market concentration. Taken together, their message is clear: selectivity, diversification and disciplined risk management are becoming increasingly essential as the AI theme evolves.

T. Rowe Price

Justin White - US Equity Leaders

AI is unquestionably transformative, but we are increasingly sceptical about the returns expected on some of the current spending, particularly where there is large spend required on physical assets before returns are realised, business models are unclear, or expectations rely on open-ended assumptions. AI itself is not a fad, and core beneficiaries with scale, data and pricing power can compound for many years. Risk is highest in areas where spending is running far ahead of monetisation and monetisation itself is not providing a clean signal. Why? Because monetisation is running 4 cycles behind the technology – i.e. monetisation lags adoption, adoption lags the product and the product lags the technology.

There has been a clear shift from exuberance toward early-stage irrational exuberance in certain segments, driven by narrative, momentum and fear of missing out rather than fundamentals. Rather than exiting AI, we aim to stay in the game without betting the fund - moderating exposure and capping position sizes where necessary, and favouring durable, asset-light beneficiaries over highly cyclical or capital-hungry plays. We believe AI is real, but some technology prices may not be. The strategy reflects that by participating selectively while actively managing downside and concentration risk.

Portfolio exposure to mega-cap technology is broadly in line to modestly below the S&P 500, mostly driven by an underweight position in Microsoft. We treat the largest technology stocks as a theme or single risk factor, and a key focus is on ensuring active risk management comes from stock selection rather than index concentration. Elsewhere in software, the portfolio holds a small position in Palantir, balancing the optimism of having recently met the company - a meeting we described as the best we have ever had at T Rowe Price - with the very challenging valuation. In addition, the portfolio holds 5 other software companies: a games marketing business, a cybersecurity business and several networking software companies.

Overall, our goal is to participate in AI-led upside while remaining disciplined on valuation and maintaining a balanced, resilient portfolio.

Schroders Multi-Asset Team

Philip Chandler & Tara Fitzpatrick - Omnis Managed Funds

We do not believe we are in a market wide bubble yet. While valuations in parts of the Technology and AI ecosystem are elevated and certain pockets of exuberance have emerged, the overall backdrop remains supported by solid fundamentals, real cash flows and ongoing structural demand for AI adoption. Importantly, the conditions typically associated with historical bubbles - extreme leverage (with companies, households and investment institutions taking on excessive levels of debt), weak underlying business models and broad based exuberance - are not present today, and recent volatility appears concentrated in specific, more speculative segments rather than the market as a whole.

Looking forward, a key area the team are monitoring is the exceptional scale of AI related capital expenditure. Investment among the largest technology companies is rising extremely rapidly, with some planning to double their capital expenditure year on year. This creates a clear dependency: the ability to sustain such investment over time will require earnings to scale accordingly. While revenue growth in many AI linked businesses has been strong, the gap between rising capital expenditure and free cash flow highlights the importance of monetisation and return on investment. The market’s willingness to tolerate high levels of spend is not unlimited, and the trajectory of earnings growth will increasingly determine how comfortably these companies can finance their ambitions without pressuring balance sheets.

These conditions reinforce the value of maintaining disciplined selectivity when investing in the space and avoiding areas where monetisation remains uncertain. Alongside this, diversification plays an important role. We have been broadening our exposure across regions and sectors to reduce reliance on the narrow leadership that currently characterises global equity markets. Many major equity markets are dominated by a small group of large technology stocks - headlined by the Magnificent 7 (or 8) Tech stocks in the US (Alphabet, Amazon, Apple, Broadcom, Meta, Microsoft, Nvidia & Tesla) - creating concentration risk. By combining selective stock picking with diversified regional and sector allocation, we aim to capture long term opportunities associated with AI, while managing the risks linked to elevated valuations, rapid expenditure growth and concentrated market leadership.

Omnis Investment Team

Tim Dingemans & Patrick O'Donnell - Omnis Agility & OMPS

"Houston, do we have a problem?"

Where to next for AI? There has been a lot of discussion over the last few months around the next step for the AI journey. On one hand, there is the genuine sense of wonder at how impressively certain tasks are carried out – they are executed at remarkable speed and with surprisingly little effort. On the other hand, you have the very real concerns around the sustainability of the enormous cash flows that are making AI “happen.”

Of note is the cost of hardware, the data centres, the chips and the cost and resources needed for the electrical power. As mentioned previously, many high profile transformations that inflated into bubbles eventually collapsed when the cash ran out and the underlying businesses failed. This was despite the longer term profound positive effect on society.

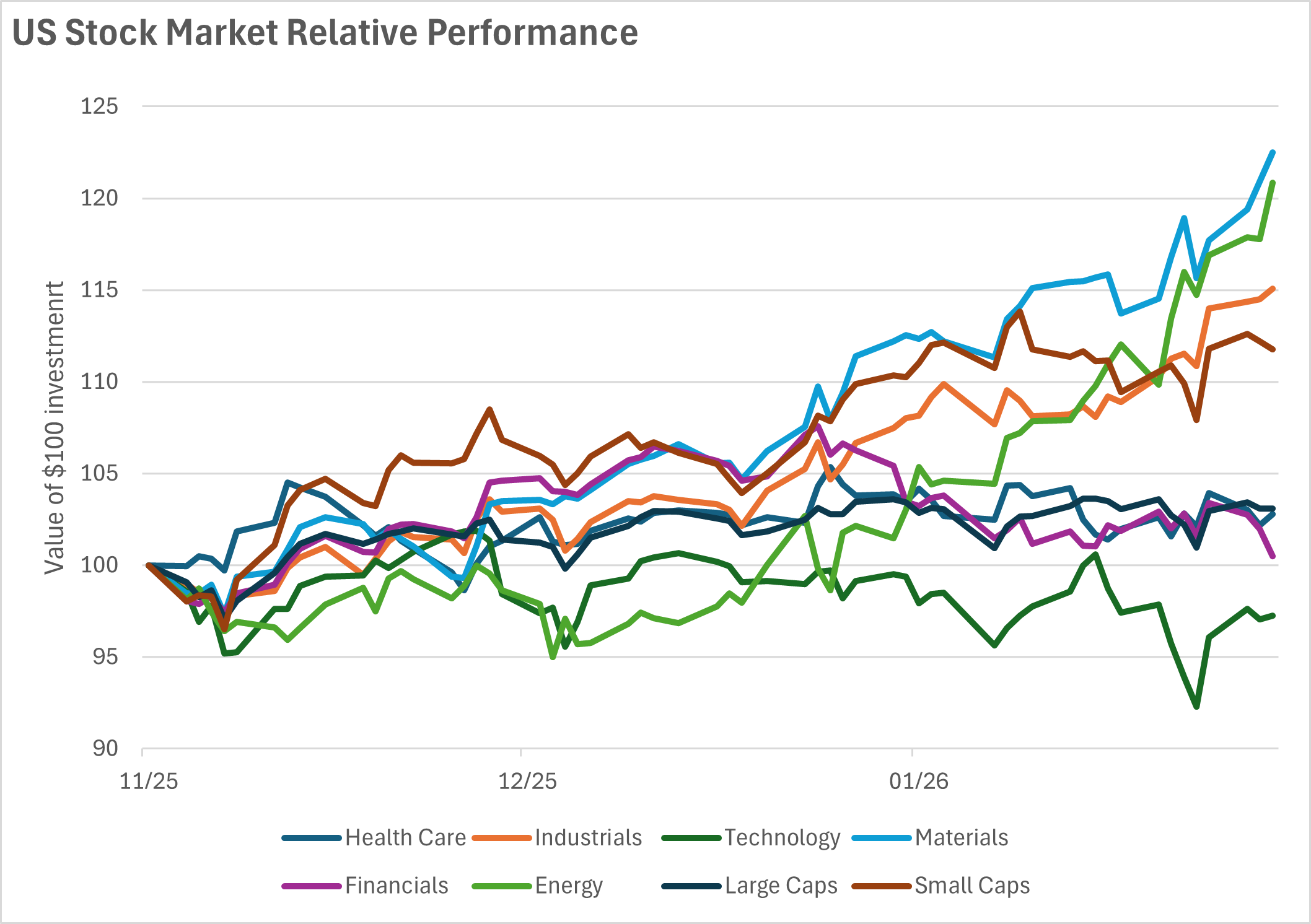

Additionally, there have been very real concerns that AI would be "eating other people’s lunches/jobs". The latest iteration of this has been the notable collapse in software providers share prices, driven by fears that AI could reduce the need for paid software subscriptions altogether. On the back of this, we have already seen a significant shift in relative sector performance in the US. Suddenly the tech sector is under pressure, whilst Energy and Health Care have been the top performers. See the last 6 months on the chart below. Indeed, only this week UBS wealth strategists have downgraded the S&P 500 IT sector to neutral.

Figure 1. 3-Month Relative Performance

*Source: Bloomberg as at 12 February 2026

We have already begun pivoting away from the S&P 500 and shifting funds into Energy, Health Care, US Small Caps and US Bonds, given our concerns over the index’s growing reliance on the Tech sector.

So, now we are at a crossroad and can fairly ask the question of the S&P 500, "Houston, do we have a problem?"

Since the start of the year, an increasing number of investment firms have been rebalancing their exposure too, whilst repeating their longer-term positive view on the US equity market. So, no one is yet deserting “the sinking ship”, but there are worries.

Our view remains that the concentration and overvaluation of the S&P 500 presents a fundamental risk to US investors, and that the US dollar is also likely to face further downward pressure. We continue to diversify away from the S&P 500 by reallocating into broader US sectors and Fixed Income, while also partly reducing our overall US dollar exposure through increased investment in other geographic regions.