Understanding the Recent Bond Market Volatility

In recent weeks, bond markets have sold off globally, pushing bond yields higher (and bond prices lower) as investors demand greater returns to hold or purchase bonds.

With this in mind, we have engaged with three of Omnis’ key investment partners: T. Rowe Price, Columbia Threadneedle and Legal & General, as well as with our Chief Investment Strategist, Patrick O’Donnell, to provide some insight on the evolving situation.

T. Rowe Price are of the opinion that there are three key factors driving bond markets in the current environment:

- Fiscal policy

- The Federal Reserve

- The U.S. labour market

Fiscal Policy

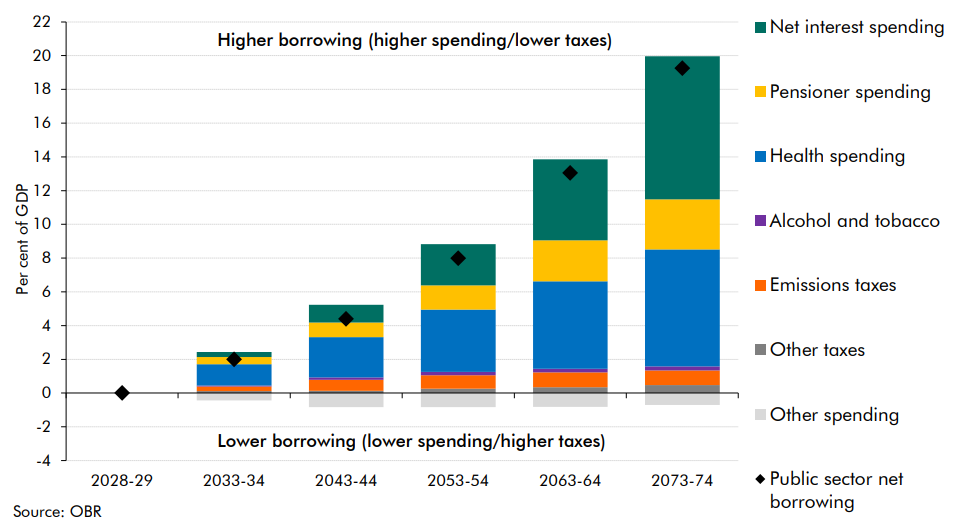

While there are nuances across different geographies, governments in general are overspending and struggling to rein it in. Defence costs are rising but the main areas of concern surround increased healthcare and pension costs (as longevity of life increases), and increased interest rate costs (following the recent period of rising interest rates).

UK Future Borrowing Forecast

Long-dated UK bond yields (the return paid by bonds with a long time to maturity) have moved higher year-to-date, however, they have risen less so than other countries, namely Germany, France and Japan.

The Bank of England is selling Gilts (that were purchased via Quantitative Easing programmes), which is effectively increasing the supply of bonds that the market needs to absorb (more supply means lower prices/higher yields all things being equal). Omnis Investments Chief Investment Strategist Patrick O’Donnell is of the view that if the Bank of England were to pause their selling programme, this would lend support to the bond market.

To clarify, this is not an issue specific to the UK. Columbia Threadneedle outlined that the onslaught of government bond supply is at record levels for many developed countries.

The Federal Reserve (The Fed)

Investors are now pricing a high likelihood for U.S. policymakers to cut interest rates in September in response to a softening U.S. labour market and pressure from the Trump administration. President Donald Trump has been vocal in his campaign to lower interest rates, but he has also attempted to replace FOMC member, Lisa Cook, with someone more aligned to his views. This has seen longer-dated bond yields spike, and the likelihood of interest rate cuts has increased despite inflation remaining elevated, highlighting investors are now concerned as to whether the Fed can maintain price stability in the long-term.

The U.S. labour market

U.S. labour market concerns are fuelling expectations of a September interest rate cut. The U.S. economy now has roughly one job for each unemployed worker, the lowest level since the pandemic. However, on Tuesday the Bureau of Labour Statistics revised its estimate of US job growth down by 911,000 (for the year ending in March), the largest negative revision since 2002. Concerns over a slowing labour market are being offset by a continuation of loose fiscal policy, particularly the One Big Beautiful Bill Act which extends tax cuts, deregulates and will ultimately add approximately US$4 trillion to the U.S. debt pile over the next 10 years. This continuation of loose fiscal policy and increased U.S. Treasury issuance raises concerns of debt sustainability, which remains a key concern for markets.

Columbia Threadneedle's outlook

Columbia Threadneedle manages the Omnis UK Gilt and Omnis Sterling Corporate Bond Funds.

Economic growth in the UK has been sluggish, and inflation remains above target, which creates a challenging environment for the Bank of England. Columbia Threadneedle indicated that since April, employment has fallen while prices in certain sectors have risen. This has led to a slower path for interest rate cuts, despite a softening labour market. They highlight that we are likely to see taxes increase in November and without a further deterioration in the labour market, the Bank of England is likely to tread carefully until we see inflation ease.

T. Rowe Price's outlook

T. Rowe Price manages the Omnis Strategic Bond Fund

Whilst equity markets are focusing on easing monetary policy in the near-term, the U.S. economy is still exposed to multiple inflationary forces; higher tariffs, a weaker U.S. dollar, falling labour supply and loosening fiscal policy. When combined with the impact of high fiscal issuance, T. Rowe Price believes that the path for U.S. yields is higher in the medium-term.

Legal & General's outlook

Legal & General will take investment management responsibility of the Omnis Global Bond Fund in late September 2025.

Global bond markets are still trying to digest the real-world implications of the US government’s challenge to Fed independence, its trade war and its more aggressive foreign policy. Investors are simultaneously scared of high inflation and recession. Amid these twin concerns, yields of bonds have increased, particularly for bonds with longer maturities. Credit spreads (the difference in yields between bonds issued by companies and bonds issued by governments) remain tight relative to historic valuations and with no shortage of potential catalysts for volatility, we believe a cautious outlook is warranted. We maintain a neutral credit outlook.

www.omnisinvestments.com

Issued by Omnis Investments Limited. This update reflects the views of Omnis, and its investment managers, at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.