US Equities Hold Steady as Hopes of a Rate Cut Build

Global stock markets have been buoyed higher by renewed speculation of a December rate cut.

A late recovery.

US stocks rallied towards the end of November as rising expectations of a December interest rate cut by the US Federal Reserve (Fed) offset concerns over elevated tech valuations. Markets were buoyed when the chances of a December cut increased after New York Fed President John Williams signalled that rates could start to fall in the near term.

Strong results from big tech giants helped push stocks higher, while earnings outside the Magnificent Seven also exceeded expectations. Even so, overall performance across the wider market was mixed, with indices finishing broadly where they began.

US labour data was finally released after the longest US government shutdown ended after 43 days. It showed a surprising jump in jobs in September, although unemployment reached a four-year high. Employers added 119,000 jobs, more than expected, while unemployment ticked up from 4.3% to 4.4%. However, the October jobs and inflation reports have been cancelled, and November data has been pushed back until after the Fed's December meeting, leaving policymakers without up-to-date figures.

Reeves unveils Autumn Budget.

Chancellor Rachel Reeves unveiled £26bn of tax rises in her second Autumn Budget, including a three-year freeze on income tax thresholds and the scrapping of the two-child benefit cap. Other measures included an electric vehicle excise duty, a mansion tax on properties over £2m and changes to Cash ISA limits.

The Bank of England kept interest rates unchanged at 4%, noting that borrowing costs are likely to continue falling. UK inflation fell for the first time since March, easing from 3.8% in September to 3.6% in October. Meanwhile, unemployment rose more than expected to 5% in the three months to September, the highest in four years, while wage growth slowed to 4.8% – further fuelling expectations of a December rate cut.

China's economy slows.

Asian stocks came under pressure after China’s slowdown worsened, weighed down by weak consumer demand and the property slump. Factory output and retail sales grew at their weakest pace in over a year, and exports contracted sharply, including a 25% drop in shipments to the US. Property investment continued to decline, shrinking 14.7% in the year to October. China's consumer prices rose 0.2% from a year earlier, suggesting deflationary pressures may be easing.

Meanwhile, business activity in the eurozone grew steadily in November, with manufacturing losing momentum but the services sector remaining robust. Eurozone inflation eased to 2.1% in October, nearing the European Central Bank's target. The euro area posted a €19.4bn trade surplus in September, up sharply from €1.9bn in August and well above levels recorded a year earlier.

Japan's economy shrank by 1.8% on an annualised basis in the third quarter, the first contraction since early 2024. A drop in exports, notably car parts that have been hit by America's tariffs, dragged down growth, but household consumption remains weak amid rising prices.

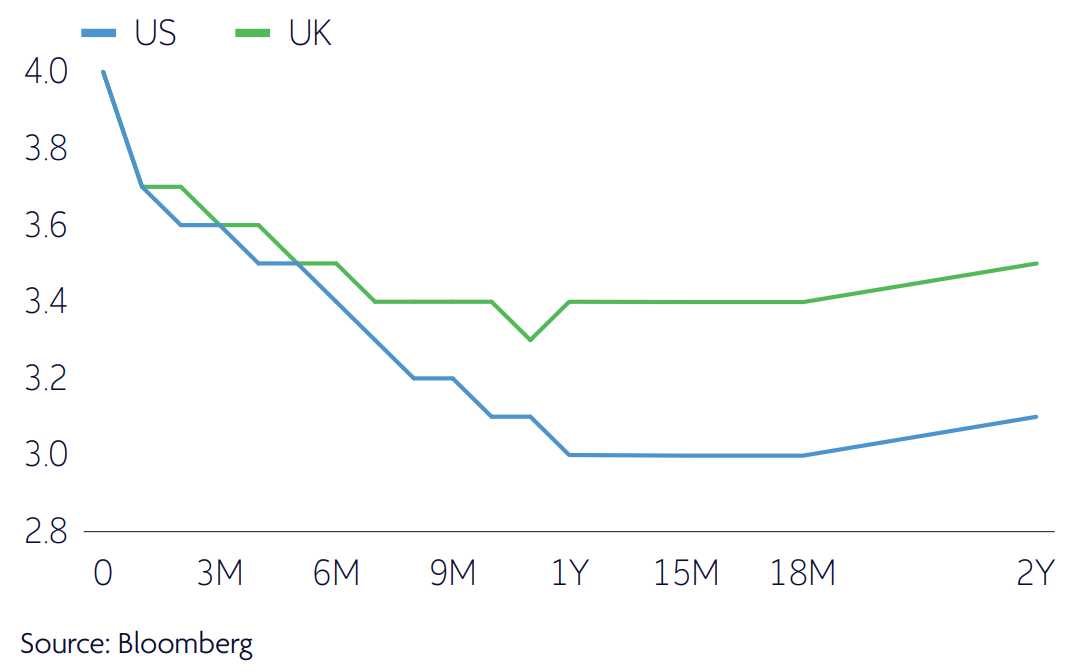

Figure 1. Interest rate expectations (%)

The general direction of travel is lower over the next two years as major central banks look to boost their economies.

Download Omnis Market Update (.pdf)