Venezuela and the Impact on Markets

What happened?

US forces seized Venezuelan President Nicolás Maduro and his wife Cilia Flores in an operation on January 3rd and transported them to the US. There is now talk of potential regime change.

Why is it important?

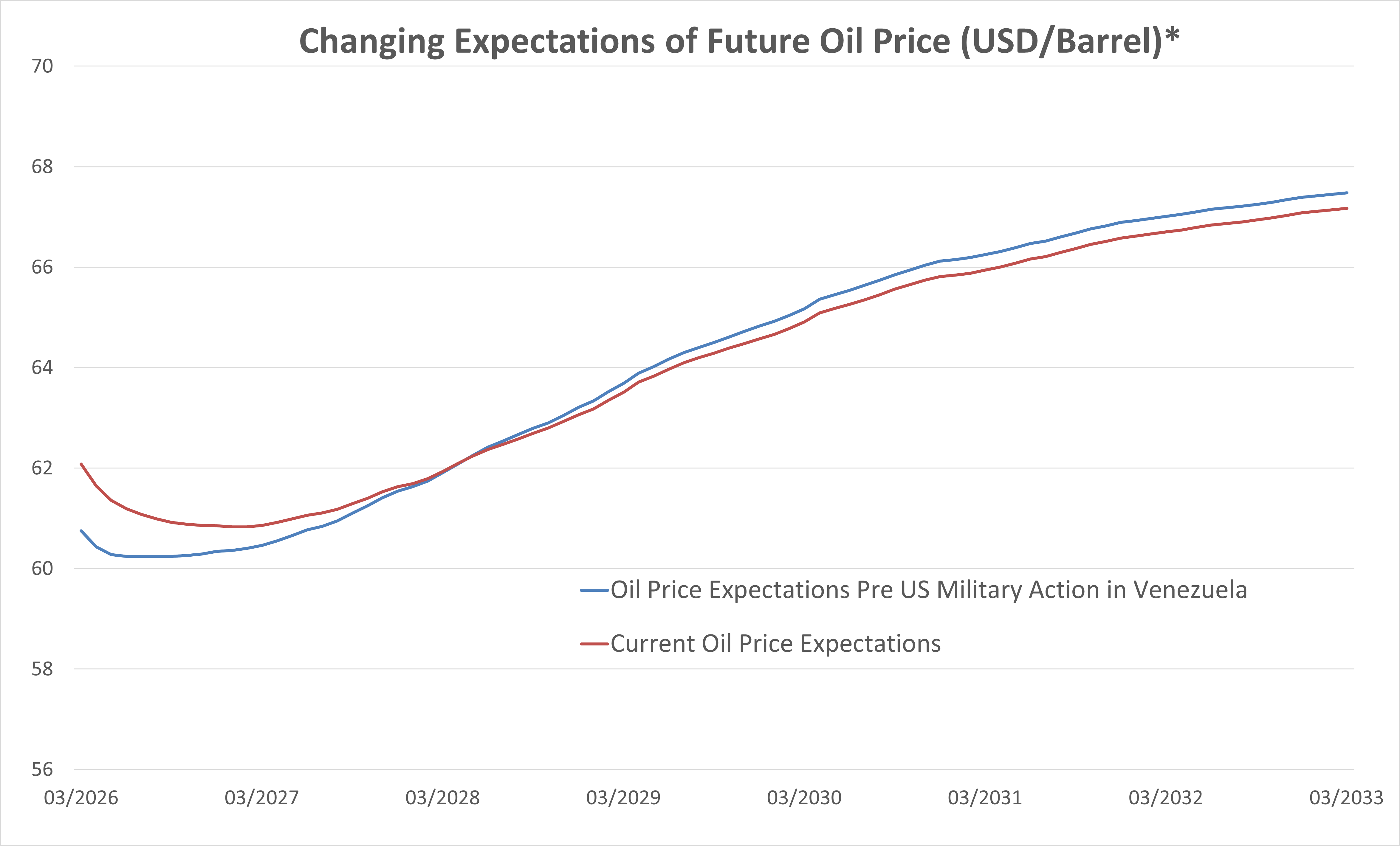

Venezuela holds nearly one-fifth of global proven oil reserves. However, decades of poor management and a lack of investment has meant that crude oil production remains relatively low. Venezuela produces about 1 million barrels of oil a day, which is about a third of what it was producing in 2000 and accounts for ~1% of global oil production today. Any regime change may open the door to increased investment in the sector from foreign private energy companies, which could potentially increase the supply of oil hitting global markets, adding downward pressure on prices. There have been only modest moves in markets so far. The future price of oil has moved lower, while the current price of a barrel of oil has in fact moved higher on increased geopolitical risk.

*Source: Bloomberg

What's our view?

The political figurehead has been removed but the regime still stands. Vice President Delcy Rodriguez has been sworn in as Interim President, there has been a public endorsement from Maduro’s son and reports suggest that there has been a wave of repression to consolidate power. Infrastructure decay and years of underinvestment remain significant challenges. Addressing these issues will not be a quick fix, and any meaningful increase in production is likely to take years. Political uncertainty and the absence of guarantees for foreign oil companies further limit prospects for near-term investment.

Despite these constraints, the energy sector has performed strongly year-to-date, though this may be driven by developments in neighbouring country, Guyana. President Maduro recently asserted claims over Guyana’s oil-rich Essequibo region, estimated to hold around 11 billion barrels of oil reserves. His capture could neutralise this territorial dispute and potentially secure production of approximately 1.7 million barrels per day.

Beyond the oil market, these events highlight a theme that is already present in markets and underscores the incentives for global defence spending, particularly in the likes of Europe, Japan and potentially Australia.

What to watch from here?

There have been positive overtures from both President Trump and Delcy Rodriguez but the situation is fluid. Watch for increased communication between the White House and Caracas and/or any potential agreement on energy access for external oil companies. Watch the wave of suppression develop and if it causes further political instability. There may be further US operations in Venezuela and given the forceful action taken by the US, there may be other operations carried out in the region and across the globe. A key focus remains around how other countries, such as Russia and China react, and whether there are further geopolitical ramifications.

The Omnis team are continuing to monitor the risk to other regions closely, including but not limited to Colombia. President Trump recently made threats that the US could take similar action in Colombia, raising tensions between the two countries. The Omnis Strategic Bond Fund (approx. 6.65% weighting in the Omnis Agility IV Portfolio) holds approx. 0.84% exposure to Colombian bonds, while the iShares MSCI EM Latin America ETF (approx. 1% weighting within the Omnis Agility IV Portfolio) holds a 1.91% weighting to Colombia.