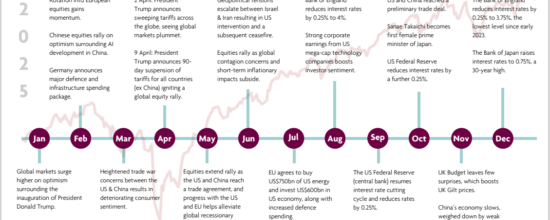

Market Update - June 2025

Global markets climb on tariff truce

A temporary easing in US–China trade tensions and better-than-expected economic data lifted markets.

Markets rise on trade relief

Markets rallied in May after the US and China agreed to suspend tariffs for 90 days, easing fears of a prolonged slowdown. The truce marked a significant de-escalation in trade tensions and helped lift global sentiment. US stocks rebounded strongly, recovering losses from President Trump’s “Liberation Day” tariffs, supported by robust corporate earnings and better-than-expected retail and manufacturing data. European indices also gained, helped by solid first-quarter results and easing trade concerns. The FTSE 100 hit a two-month high, with energy and financial stocks among the strongest performers. Asian shares rose after China’s central bank cut interest rates and injected liquidity to support businesses hit by weaker exports.

Mixed signals in the US

US inflation slowed to 2.3% in April. While many tariffs were later rolled back, analysts warned the full economic impact may still be felt. The US economy shrank by 0.3% in the first quarter. One reason was that many businesses rushed to bring in goods before tariffs were introduced, which boosted imports at the end of last year but made the start of this year look weaker by comparison. Although the trade pause has eased some concerns, there are worries that it could also mean fewer support measures from the US central bank. For now, the Federal Reserve has kept interest rates steady at 4.25% to 4.5% and said it’s keeping a close eye on economic risks. Meanwhile, the job market remained steady. Employers added 177,000 jobs in April and the unemployment rate held at 4.2%.

UK beats expectations

The UK economy grew 0.7% in the first quarter – the fastest pace in a year – helped by resilient consumer spending and a rise in business investment. New trade deals with the EU, US and India focused on tariff cuts, improved market access and closer international cooperation. Inflation rose to 3.5% in April, mainly due to higher energy and transport costs. In response, the Bank of England cut interest rates to 4.25% to help support the economy as living costs continue to rise. Although unemployment edged up to 4.5% and job vacancies fell, consumer confidence improved, turning positive for the first time in five months. This shift suggests households are starting to feel more optimistic about the economic outlook.

Asia rebounds on tariff deal

Asian markets rose after the US slashed tariffs on Chinese goods from 145% to 30%, with China cutting its own from 125% to 10%. The tariff truce followed months of declining factory output and reports of layoffs in export-reliant sectors. In response, China announced further stimulus measures, including interest rate cuts and a liquidity boost to ease credit conditions.

Europe lifted by delay

European stocks gained after the US delayed new tariffs on EU imports until July. The eurozone economy grew 0.4% in the first three months of the year, which is double the previous quarter, as firms rushed shipments ahead of expected tariffs. Eurozone inflation held at 2.2% in April, slightly above the European Central Bank’s target. The ECB cut rates for the third time this year and signalled more easing may follow in June as trade uncertainty clouds the outlook.

Figure 1: Fading away

The pace of inflation has been falling towards the 2% central bank target across most major economies since the pandemic peak.