Stock Markets End 2025 on a High

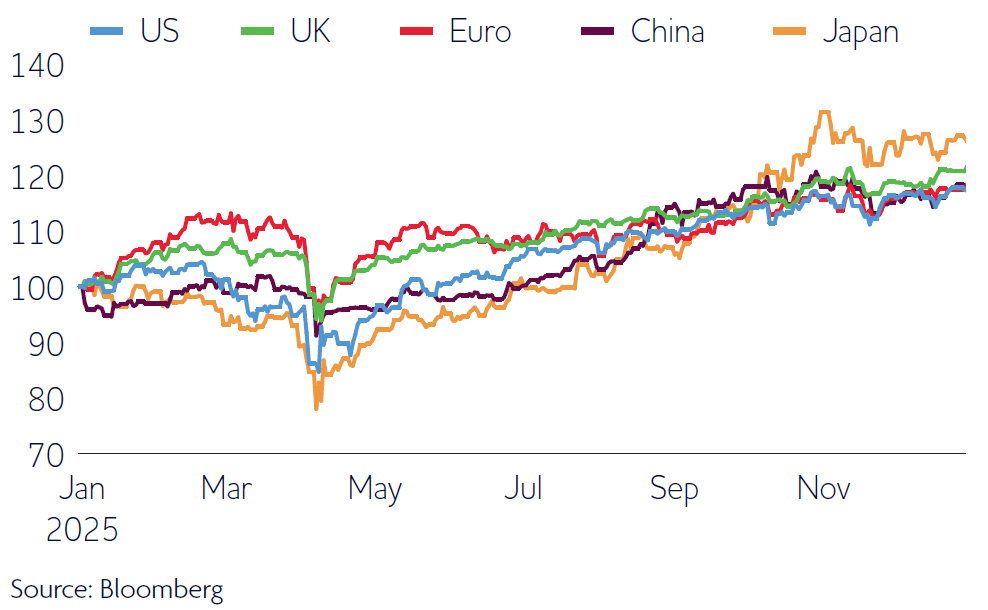

Equity markets closed the year strongly as investors looked past tariff turmoil.

Equities shrug off uncertainty.

Markets finished the year strongly, with major indices ending on a high. Global equities looked past the turmoil caused by President Donald Trump's tariffs, posting a third consecutive year of double-digit gains in 2025.

US stocks also enjoyed a robust year, supported by solid corporate earnings, enthusiasm around artificial intelligence and optimism over potential interest rate cuts from the Federal Reserve (Fed). Meanwhile, the FTSE 100 recorded its strongest annual performance since 2009.

Stocks and bonds rallied in December after the Fed cut interest rates by a quarter point to between 3.5% and 3.75%, a three-year low. However, the bank signalled that the pace of cuts could slow going forward amid a cooling labour market and persistently high inflation. With policymakers sharply divided at the latest meeting, projections now show just one rate cut in 2026.

US inflation slowed in November, although the report was distorted by missing data from the start of the month. Prices rose 2.7% in the 12 months to November, down from 3% in September and below many analysts' expectations.

The headline unemployment rate continued to edge higher, reaching 4.6%, up from 4.4% in September and a four-year high. Jobs growth was stronger than expected in November, with employers adding 64,000 jobs following a decline of 105,000 in October. That earlier fall largely reflected a 162,000 reduction in federal employment linked to the Trump administration's push to cut jobs.

UK interest rates fall.

The Bank of England cut interest rates by a quarter point to 3.75% in December, the lowest level since early 2023. However, it also signalled that the pace of cuts is likely to slow in 2026 amid stubbornly high inflation and concerns that wage growth remains elevated.

The move followed a run of softer economic data. Inflation eased more than expected in November to 3.2%, down from 3.6% the previous month. In another sign that higher taxes are weighing on the economy, the unemployment rate rose to 5.1%.

The UK economy unexpectedly shrank by 0.1% in the three months to October. Uncertainty ahead of the Budget dampened consumer and business spending, while a cyberattack at Jaguar Land Rover continued to disrupt car production.

Bank of Japan raises rates.

Japanese equities and bond yields rose after the Bank of Japan (BoJ) raised its policy rate to a three-decade high. While headline inflation has eased to 2.9%, it has remained above the 2% target for nearly four years. Most economists now expect the BoJ to raise rates once more in 2026, to around 1%.

China's economy lost momentum in November amid a slump in spending and investment. Factory output growth slowed to a 15-month low, while retail sales recorded their weakest year-on-year growth since 2022. The property sector remains a significant drag, with home prices across China's 70 major cities continuing to fall.

The European Central Bank (ECB) kept rates on hold at 2% and raised its growth forecasts for 2026 and 2027. Most economists expect rates to remain unchanged throughout 2026 unless there is a significant economic shock. Eurozone inflation unexpectedly rose to 2.2% in November, above the ECB's 2% target for a third consecutive month.

Figure 1. Equity markets end the year on a high

Rate cuts and economic growth support gains across most regions.

Download Omnis Market Update (.pdf)