Market Update - September 2025

Global stock markets rally to record levels

Hopes of lower US interest rates and strong company earnings results drive share prices higher

Record highs.

Global stocks hit record levels after steady US inflation strengthened expectations of a Federal Reserve (Fed) rate cut in September, while an extension of the US–China trade truce boosted sentiment. Earnings season added further momentum, with most companies beating forecasts. However, UK government borrowing costs climbed as yields on long-term bonds increased.

US consumer price inflation held steady at 2.7% in July. Core inflation, excluding food and energy, rose to 3.1% – the fastest pace in six months. US producer prices, a measure of wholesale costs, increased 3.3% year-on-year, another sign tariffs are weighing on the economy.

Fed Chair Jerome Powell signalled a possible September cut, while suggesting the inflationary impact of President Donald Trump’s tariffs may be temporary. Tensions escalated after Trump ordered the removal of governor Lisa Cook, giving him the chance to nominate a replacement and increase his influence.

The jobs market has become a key focus for the Fed. Payrolls for May and June were revised lower, followed by a weak July report. Unemployment also rose to 4.2% from 4.1%. This softer trend has been central in shifting expectations towards a September rate cut.

UK inflation surprise.

UK consumer prices rose after summer travel pushed air fares higher. The annual rate rose to 3.8% in July, up from 3.6% the previous month and the highest in 18 months. The Bank of England cut rates for the fifth time in a year, lowering them by 0.25 percentage points to 4%, while warning that food prices could add further pressure.

The move brings borrowing costs to their lowest since March 2023, against a backdrop of slowing growth. Most economists expect Chancellor Rachel Reeves will have to raise taxes in the Autumn Budget, as subdued growth and higher borrowing costs have made it harder to meet fiscal targets.

Growth slowed to 0.3% in the second quarter, down from 0.7% in the first. The labour market also cooled: unemployment rose to a fouryear high of 4.7% in the three months to June, while vacancies fell.

Asia rallies on tariff pause.

Asian equities advanced after Trump signed an executive order pausing higher tariffs on Chinese imports for 90 days. China’s economy weakened in July as domestic and external pressures weighed. Industrial output grew 5.7%, down from June’s 6.8%, while retail sales rose at the slowest pace since December 2024.

Exports were a relative bright spot, climbing 7.2% year-on-year, while imports grew at the fastest pace in a year as businesses moved quickly to benefit from the pause. Despite the truce preventing sharper tariff hikes, manufacturers remain under pressure from weak demand and falling factory prices. Even so, Chinese equities rallied strongly, with the mainland CSI 300 index gaining 10% over the month (figure 1).

Meanwhile, eurozone inflation stayed at 2% in July, with lower energy prices and a stronger euro keeping costs contained. GDP rose just 0.1% in the second quarter, compared with 0.6% in the first, though demand has held up.

Trade tensions with the US eased after an agreement to apply 15% tariffs on most exports, averting a broader trade war between two of the world’s largest economies.

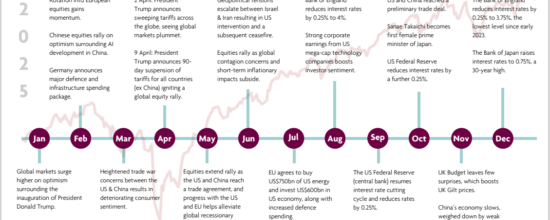

Figure 1: Chinese equities rebound

The CSI 300 index surged 10% in August as tariff tensions eased, even as economic data showed signs of slowing.

Download Omnis Market Update (.pdf)