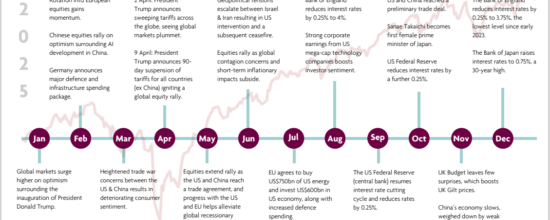

Market Update - July 2025

Markets resilient amid Middle East conflict

Stocks surge despite geopolitical uncertainty, with the FTSE 100 and US markets leading the way.

President Trump eases back on tariffs

It was another strong month for global stocks despite rising tensions in the Middle East, with markets shrugging off concerns about the conflict. Brent Crude oil prices rallied above US$80/barrel following US airstrikes on Iran’s nuclear facilities, before retreating towards US$67/barrel after the announcement of a ceasefire. Investor concerns subsequently eased, with fears of an escalation and rising inflation mitigated. Global stocks continued their positive momentum after Trump rolled back on tariffs in May. Meanwhile, the FTSE 100 soared to a record high and the pound hit its highest level against the dollar for more than three years. US consumer prices continued to rise in May, though not as much as expected despite Trump’s tariffs. Inflation rose 2.4% year-on-year in May, up from 2.3% the previous month. Inflation is expected to rise further as the impact of tariffs is passed on to consumers and businesses. In anticipation of further inflationary pressures the US Federal Reserve (Fed) held borrowing costs between 4.25% and 4.5%. Fed policymakers are expecting two more rate cuts this year. Whilst the US economy has remained robust, there are now signs it is slowing. The US economy added 139,000 jobs in May, compared with 147,000 jobs added in April. The unemployment rate remained stable at 4.2%, whilst US manufacturing fell for a third straight month after factories were hit by a slump in export orders. Meanwhile, imports tumbled to their lowest level since 2009.

UK stock market surges

The FTSE 100 reached a new record high, close despite the economy shrinking in April. Chancellor Rachel Reeves refused to rule out tax rises after GDP contracted by 0.3%. The figure was higher than expected and came after Trump’s “Liberation Day” tariffs, tax increases for businesses and a £2 billion monthly plunge in exports to the US. The Bank of England is forecasting GDP growth to slow from 0.7% in the first quarter to 0.25% in the second quarter. The Bank of England held interest rates at 4.25% after inflation remained unchanged from the previous month at 3.4%. Financial markets still expect two rate cuts to 3.75% by the end of this year. Meanwhile, UK unemployment rose to a four-year high of 4.6% in April. Annual pay growth eased to 5.2%.

US and China trade deal

The US agreed on a trade framework with China to boost supplies of rare earth minerals and magnets for the automotive industry, and will raise total tariffs on Chinese goods to 55%. China will impose a 10% tariff on US imports. China’s factory output growth slowed to a six-month low in May, while retail sales picked up, offering some relief for the world’s second largest economy. Industrial production rose 5.8% year-on-year, down from 6.1% in April. In contrast, retail sales grew 6.4%, accelerating from April’s 5.1% rise. Weakness in the Chinese property sector persists, and deflation also remains a concern. Meanwhile, the European Central Bank (ECB) cut interest rates for the eighth time in a row to 2% in a bid to boost its flagging economy in the wake of Trump’s tariffs. Annual inflation in the eurozone fell to 1.9% in May, down from 2.2% in April and below the ECB’s 2% target Cooling inflation has taken place more rapidly than the ECB predicted earlier this year, partly thanks to a stronger euro, making imported goods cheaper, and lower-than-expected energy costs.

Figure 1: Stock market resilience Despite the April dip driven by tariffs, both the FTSE 100 and S&P 500 have posted solid year-to-date gains.