Market Update - August 2025

Stocks push higher on trade deal optimism

Global equities climbed in July as renewed hopes for trade agreements buoyed investor sentiment

All-time highs

Global stocks enjoyed another strong month,

with several indexes hitting record levels. US markets surged, driven by

the tech sector and optimism over trade negotiations. Sentiment was

further lifted after the US and EU struck a trade agreement. UK shares

initially faltered amid speculation that Chancellor Rachel Reeves might

resign but soon recovered. The FTSE 100 later climbed to a new high as

investors brushed off trade war concerns.

The US announced further trade agreements with South Korea and

Japan, adding to recent deals with Britain, Vietnam and Indonesia, and

maintaining a tariff truce with China.

Despite pressure from President Donald Trump, the US Federal

Reserve held its benchmark rate steady. Markets are currently pricing

in one cut later this year, likely in September. Meanwhile, US inflation

rose to 2.7% in June from 2.4% in May, as the impact of tariffs began to

feed through to consumers.

The US economy and labour market remained resilient. The economy added 147,000 jobs in June, defying fears that tariffs would dampen hiring. The unemployment rate declined to 4.1%, down from 4.2% in May. The dollar, which had its worst start to a year since 1973, has also steadied on the back of stronger data.

UK inflation rises

UK inflation rose unexpectedly to an

18-month high of 3.6% in June, up from 3.4% in May – a setback for

the Bank of England, which is still expected to cut rates in August and

again later this year.

GDP fell by 0.1% in May after a 0.3% contraction in April, raising fears

the economy could be slowing more than anticipated following a

strong start to the year.

Unemployment climbed to 4.7%, the highest in four years, while wage

growth eased from 5.3% to 5%. Reeves is expected to raise taxes in the

autumn Budget, though a weaker outlook and rising joblessness could

make this politically difficult.

EU and US trade deal

After months of negotiation, the EU

and US agreed on a trade deal, with 15% tariffs on European exports

to America – half the 30% import tax Trump had threatened. The

European Central Bank (ECB) kept interest rates on hold at 2% amid

ongoing uncertainty. It has already cut rates four times this year.

Eurozone inflation rose in June, returning to the ECB’s 2% target.

The rate was up from 1.9% in May, the first increase since January,

reinforcing the ECB’s cautious stance.

Meanwhile, China’s economy shrugged off the impact of Trump’s trade

wars in the second quarter, growing by 5.2%. The world’s secondlargest

economy has so far avoided a downturn, helped by Beijing’s

stimulus measures and a trade truce with the US. Exports rose 5.8% in

June as firms took advantage of the truce to ship goods ahead of the

August deadline for a more definitive deal.

However, the Chinese economy continues to face challenges. Inflation

turned positive for the first time since January, but deflationary

pressures continue to cast a shadow. Despite efforts to stimulate the

economy, weak domestic demand is still dragging on growth.

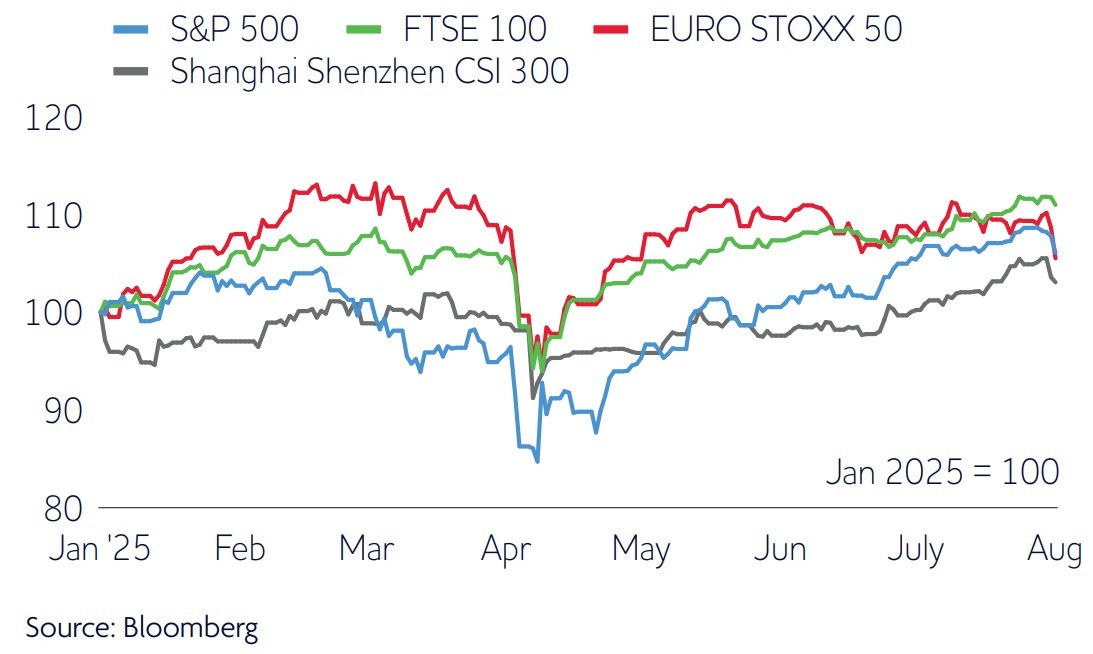

Figure 1: Stock market performance Despite the dip following the announcement of Trump’s tariffs in April, equity markets have delivered positive returns so far this year.