An optimistic outlook for bonds in diversified portfolios

With inflation trending lower and interest rates expected to come down, government bonds are set to deliver solid returns, reinforcing their role as an essential part of diversified, multi-asset portfolios in the year ahead.

Bonds are a type of loan in which investors in essence lend money to a company or government for a fixed period, usually several years. In return, the investor receives regular interest payments, and at the end of the term, the original investment is repaid.

In the UK, government bonds are known as gilts, while in the US, they are called Treasuries.

Government bonds make up the largest share of the bond market and are generally considered lower risk, particularly those issued by developed economies. This is because governments are seen as less likely to default on their debt obligations.

How government bonds provide returns

The primary source of return for government bonds is income, which comes in the form of interest payments. When an investor buys a government bond, they are essentially lending money to the government in exchange for regular interest payments, known as the coupon. These payments are typically fixed and made semi-annually or annually. For example, a UK gilt with a 4% coupon will pay £4 per £100 of face value each year until maturity (the day you get your investment back). Investors can also earn returns through capital gains. If you own a government bond, you could hold it until its maturity (when the government should repay the loan and any outstanding interest) or you can sell it to another investor before maturity. The price you sell it at may differ from the original purchase price, which could lead to a profit for you. Bond prices tend to fluctuate due to changes in interest rates, inflation expectations and investor sentiment.

How government bonds work

A bond’s yield is the interest an investor expects to receive each year until it matures. Bond prices and yields move in opposite directions – when prices rise, yields fall, and vice versa (figure 1). When interest rates fall, existing bonds become more valuable because they offer higher fixed payments than newly issued bonds. When rates rise, bond prices typically drop. Investors who sell a bond for more than they paid make a capital gain, while those selling at a lower price take a loss. Holding a bond to maturity means you typically receive face value, usually £100 per gilt in the UK. If you buy a gilt at a lower price, as an investor you can benefit from the price increase of the bond as well as the regular interest payments.

Why the outlook is improving

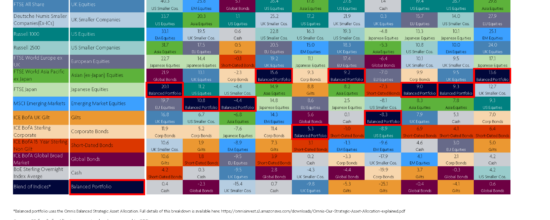

Government bonds have faced challenges in recent years, particularly in comparison to equities, which have delivered strong gains. Rising interest rates and persistent inflation meant that bond prices fell significantly, leading some investors to question their effectiveness. However, as we move into 2025, several factors suggest a more supportive environment for government bonds, reinforcing their value within a balanced, multi-asset portfolio.

A stabilising environment for bond markets

The strongest headwindfor bondholders in recent years has been rising interest rates, which pushed bond prices lower. However, with inflation moderating and economic growth subdued, the risk of further rate hikes is low. This environment removes a major source of volatility, allowing government bonds to resume their traditional role as a stabilising force in diversified portfolios.

Interest rates are likely to fall

Government bonds typically perform well when interest rates decline, as lower rates push bond prices higher. With inflation trending lower, the Bank of England has shifted its focus toward potential rate cuts. Markets currently anticipate interest rates to fall a further 0.25 to 0.50 percentage points during 2025. Even if the pace is slower than expected, rates are more likely to fall than rise, creating a more favourable environment for bond performance (see figure 2).

Yields remain attractive

Despite expectations for lower interest rates, government bond yields remain elevated compared with historical levels – and importantly, above inflation. This means that while investors wait for potential capital gains as bond prices rise, they continue to receive a strong income stream. This yield not only provides a reliable return but also helps generate returns that outpace inflation, reinforcing bonds’ role as a valuable component of a diversified portfolio.

A vital diversifier alongside equities

While equities have been the primary driver of portfolio returns in recent years, government bonds remain essential for managing risk. Historically, bonds have performed well during periods of economic uncertainty, acting as a counterbalance to equity market volatility. The proportion of bonds you should have in a portfolio will depend on your risk profile. With market conditions likely to shift, the role of government bonds as a diversifier and stabiliser is likely to be increasingly important. Investors in multi-asset portfolios may find that bonds once again contribute positively in periods where equities struggle. A long-term perspective While short-term performance fluctuations are inevitable, government bonds continue to serve a crucial function in multi-asset investing – providing income, managing risk and helping to deliver more stable returns over time. With conditions now turning more favourable, they are well placed to contribute positively in the year ahead. If you’d like to know more about the long-term growth opportunities of investing, please speak to your financial adviser.