Investment Principles - 5 Key principles to successful investing

In this video, we look at five essential investment principles that can help you navigate the complex world of investing and build long-term wealth.

Power of Compounding

First on our list is the power of compounding. Compounding is the process where your investment earnings generate their own earnings. This means that the earlier you start investing, the more time your money has to grow. For example, by reinvesting the interest you could have earned in US equities over the past 20 years, your average annual return would have been 9.3%. Without reinvesting that income, your returns would have only delivered 7.2% per annum.

Bond Income

Next, let’s talk about bonds. Did you know that income, rather than price appreciation, is the biggest driver of bond returns? Bonds pay interest, known as coupon payments, which can be reinvested or used as income. In many cases, the total return from bonds largely comes from this interest income rather than fluctuations in their market price. Over the last 30 years, 97% of US government bond returns have come from income. So, when considering your portfolio, don’t overlook the consistent income that bonds can provide.

Ignore Volatility

Our third principle is all about mindset: ignoring volatility. Stock markets can be unpredictable, with prices fluctuating dramatically in the short term. But remember, these fluctuations are a normal part of the investing journey. Historically, the market has always trended upwards over the long term. Focus on your long-term goals instead of getting caught up in daily market movements. This is crucial to maintaining your investment strategy without letting emotions dictate your decisions.

Best and Worst Days

Now, let’s discuss a surprising fact: the best days in the market often come right after the worst days. Many investors panic during market downturns and sell their assets, missing out on potential recovery and gains. Historically, being invested during those volatile times can lead to significant long-term rewards. So, don’t let fear push you to make hasty decisions—stay invested.

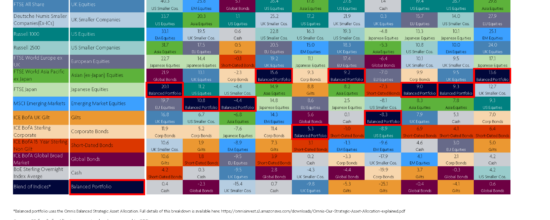

Diversification

Finally, let’s discuss the cornerstone of a robust investment strategy: diversification. By spreading your investments across various asset classes—like stocks, bonds, and alternatives—you reduce the impact of a poor performer on your overall portfolio. Diversification helps minimize risk while maximizing potential returns. Remember, never put all your eggs in one basket!

And there you have it—the five essential investment principles: the benefits of compounding, the significance of bond income, the importance of ignoring volatility, recognizing that the best days can happen right after the worst, and the value of diversification. By incorporating these principles into your investment strategy, you can enhance your chances of financial success.