Why a diversified investment strategy is important?

[Originally published 15 January 2025, Updated 23 October 2025]

What does diversification mean?

Diversification involves spreading your investments across various assets to reduce the reliance on any one investment. This helps to protect your investment portfolio and reduce the overall risk of losing money. There are three main asset classes – cash, bonds, and equities – and having exposure to each of them will help reduce the overall level of risk within your investment portfolio. If one area of your portfolio isn’t doing well, the other investments you’ve made elsewhere can compensate for those losses.

It can work on so many levels

Investing in just one company is extremely risky, because if it doesn’t perform well, you’ll lose money. Investing in lots of companies means that even if one does badly, others may do well, which will limit your losses.

Diversifying across asset classes is another strategy to reduce overall portfolio volatility. Equities and bonds have historically had a negative correlation, meaning that when one asset class performed badly, the other asset class tended to perform well (in relative terms). Whilst the combination of rising inflation and rising interest rates in 2022 saw both asset classes become more positively correlated, we firmly believe holding exposure to both bonds and equities is an important risk mitigation strategy for investors.

Meanwhile, holding cash, and cash-like investments, also acts as a volatility dampener and provides instant liquidity to take advantage of opportunities to invest in markets when the outlook becomes more attractive.

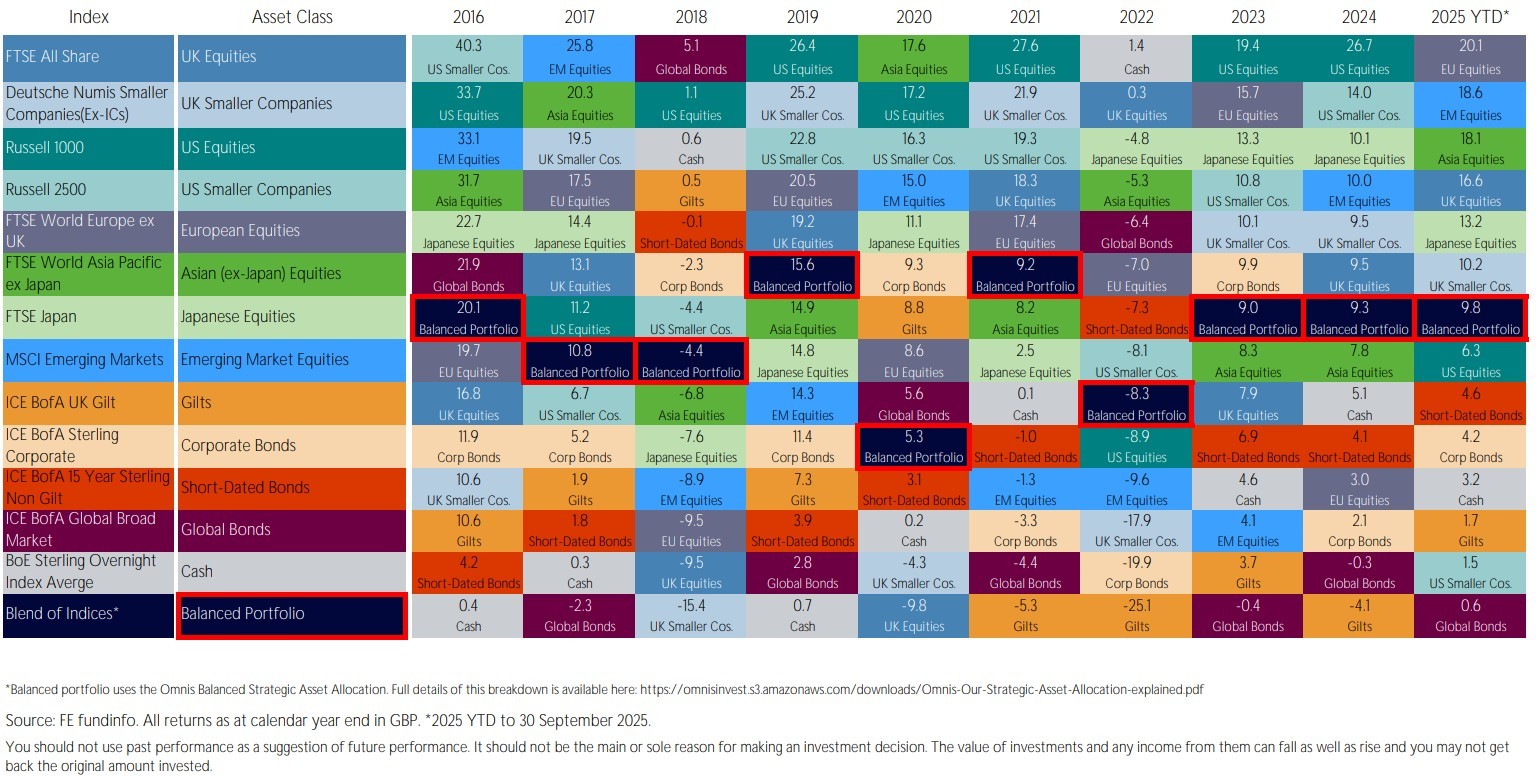

You can further diversify your portfolio by spreading your investments across geographical regions. Different regions typically experience headwinds and tailwinds at different points in time, resulting in some markets outperforming others. As an example, Emerging Markets equities were the worst performing equity market in 2023, as weak economic data out of China weighed on returns. However, fast forward to 2024 and it was the fourth-best performer and so far in 20251, the second-best performer.

1 As at 30 September 2025

Meanwhile, US Larger Companies which was the best performer in 2023 and 2024, is the second worst performing equity market year-to-date so far (in GBP terms). Trying to invest in different asset classes based on what happened in previous years is usually not a good investment strategy, as can been seen in Figure 1.

Figure 1. Performance of various asset classes from year to year

Click here to download the overview (pdf)

Diversifying across asset classes and geographies is one of the most effective ways to reduce portfolio volatility, mitigate the risk of loss and deliver more stable long-term returns.

Thinking about risk and return

Diversification won’t stop you experiencing losses, but it can help you spread your overall risk. Do remember, though, that you can’t get rid of risk completely. Any investment can go up or down in value and you could make or lose money. You should find a spread of investments and a level of risk and return that you’re comfortable with.

Assets like bonds and gilts can help offset riskier investments like shares, but the downside is they don't offer the same potential for higher returns. Cash investments are also less risky than shares, but if the cost of living rises more than the rate of any interest you're getting, your money could fall in 'real' value over time.

The investments picked for your portfolio will depend on how long you plan to invest (which should be for at least a five-year term), how much risk you’re happy to take and your financial objectives. In Figure 1, you can see a balanced portfolio of bonds and equities has performed more consistently throughout the years. Your attitude to risk and your personal circumstances, which you will discuss with your financial adviser, will inform how much of the different asset classes you should have in your portfolio.

In the long run, focusing on getting right mix of assets for your desired level of risk, and ignoring what different investments have done in the long term, will likely lead to your portfolio delivering returns that will help you achieve your financial goals.