Bubbles, Crowds and Investing

Author: Tim Dingemans - Investment Strategist

Most of us have heard of the Tulip mania collapse (1637), some the South Sea Bubble (1720). Very few the Mississippi Bubble (1720) and all of us the Dotcom (2000) and Japanese asset bubble (1989). The most famous is of course 1929, the Roaring Twenties. Each of these bubbles are caricaturised by a similar process. Extraordinary growth in upside price momentum that pulls in additional investors who fear missing out (FOMO) on an opportunity for wealth that results in the familiar upward parabolic price curve. In the end in Holland, people were literally selling their house for a Tulip bulb.

Whilst the Tulip bulb was always just a bulb; Dotcom, and before that the Railways (1845), were great and revolutionary ideas that saw earnings expectations run well ahead of cash flow. That overstretching meant that loans defaulted, people went unpaid, and suddenly financial maths overtook aspirations, resulting in gravity reasserting itself, often brutally, as prices collapsed and businesses went bust.

As an investor there is the long-term knowledge that over time sound financial planning and investing will lead to superior returns. Indeed, one only needs a return over a little over 7% return a year to double your money over 10 years with compounding. Einstein was not joking when he allegedly called compounding the 8th wonder of the world.

However, even greying investors are human, and the extraordinary returns of pre-bubble asset price climbs are just too good to miss out on.

So, we come to the billion-dollar question. Where are we now with the current Magnificent 7 (MAG7)1/AI boom? We do have a lot of bubble type characteristics – very fast and large upside in prices, high levels of concentration in the one "new winning change" and large retail investor involvement. One piece of perspective that is useful is the length of bubbles. The "20s" and "Dotcom" were 5 years long, whilst "Railways" lasted only 2 years and the "South Sea Bubble" only 1 year. Arguably, the current MAG7/AI move is somewhere between 3 and 5 years old2 i.e. right in the middle of the "danger zone".

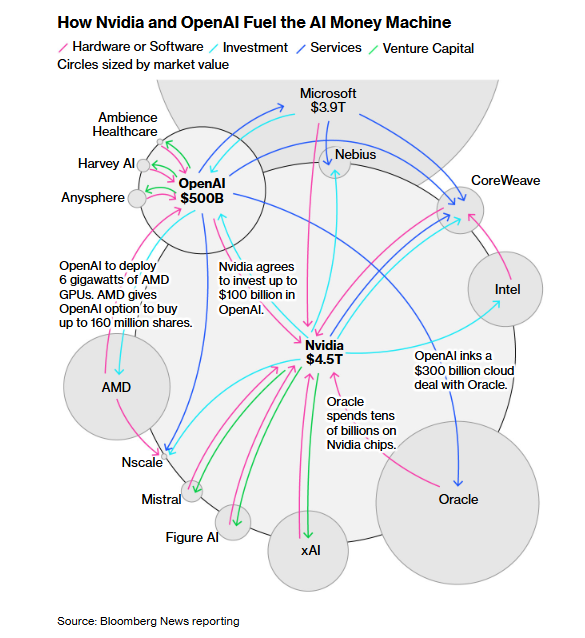

There are other areas of concern especially with AI financing. The capital/cash expenditure (capex) required to build the physical infrastructure is huge, and the final asset (the Data Centre) has a very short shelf life - only a few years. Hardly a railway line that will be there for years to come. Additionally, the capex has been financed from cash flow, but as per the recent Bain Technology Report (2025), capex funding from cash flow is expected to fall short by US$800bn by 2030. Most bubbles fail when the cash runs out, either because there is not enough cash flow being generated from the "new technology" in relation to the expenditure required – or there are no more fresh investors to support the expenditure. Another recent development is that the major AI companies have, in essence, been lending money to each other (see chart below), which could imply cash flow concerns.

Finally, the US economy in terms of jobs appears to be slowing and whilst that may be an early impact of AI taking jobs, it is more likely symptomatic of a broader weakness in the US economy. This is especially concerning for the US, as so much of the economy is driven by consumer demand (less jobs means less consumers consuming).

However, the hardest and most dangerous thing about a bubble (apart from missing out) is trying to time its end.

For us at Omnis we have a long-established investment process that looks at top down and bottom-up data to build our investment outlook. We look at specific company and sector earnings data all the way through to country and regional debt dynamics to build a well-rounded view across growth, inflation, debt, corporate earnings and the political environment. These inputs enable us to rank different assets to provide a solid starting point for investment decisions.

Our structured investment process is the reason we have not yet shifted too heavily away from holding US equities, especially when considering the valuation appeal of the less AI/Tech focused equity sectors (i.e. Healthcare/Small Caps/Energy). At this stage, we are not yet seeing enough quantitative and qualitive signs for a further pivot than our investment process has already allowed.

In summary, there remains several positive signals supporting the outlook for US equities; the home of AI.

- The US economy is still growing at +3.76%

- Tariffs are bringing in substantial fresh income for the US government, that so far US consumers are not having to pay for.

- Inflation is well off its highs, allowing the US Federal Reserve and other Central Banks to cut interest rates.

- Corporate earnings remain strong (most recently US banks)

This is all supporting the US economy and financial assets.

However, in the US there are early signals that the concentration of the MAG7/AI is indeed starting to look stretched, at a time when the broader US economy continues to grow without too much inflation.

Our concern is that the high level of debt in the US and the stickiness of inflation, especially under the new tariff regime, may lead to further reappraisal of the more hyped US assets by international investors, especially if the US dollar continues to weaken. In addition, and as mentioned above, recent weakness in US jobs data remains a concern and is a data point we are watching closely.

In summary:

At this stage, the asset ranking process has led us to modestly reduce some exposure to growth-specific stocks in favour of US smaller companies and the US Health Care sector, which offer an improving earnings outlook at more attractive valuations.

We are modestly pivoting away from being overexposed to the Tech/AI sector and closely watching for more signs to pivot further.

The risk with the unwinding of a bubble is that it negatively impacts a wider range of assets. Last Friday's (10 October 2025) substantial sell-off in the S&P 500 and Nasdaq (as well as Crypto) serves as a timely reminder.

We remain focused on the data to see if we will see a further shift in our asset ranking models.

For now, "keep calm and carry on", but also some "rigging of the ship" in case we do meet a storm. Our investment process continues to guide our decision making. This has resulted in modest portfolio adjustments so far, but more importantly, it ensures we are well-positioned to respond to any potential changes in market conditions or worsening weather.

Footnotes

1 The Magnificent 7 (Mag 7) refers to 7 of the largest US stocks: Nvidia, Apple, Microsoft, Alphabet, Meta, Tesla and Amazon

2 5 years old refers to the equity market recovery from the March 2020 lows

3 years old refers to the equity market recovery from the October 2022 lows

www.omnisinvestments.com

Issued by Omnis Investments Limited. This update reflects the views of Omnis, and its investment managers, at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. Past performance should not be considered as a guide to future performance. Please note that cash savings are relatively secure compared to investment in bonds, which involves market, credit and other risks. The value of investments and any income from them may go down as well as up and cannot be guaranteed. Prospective investors are reminded to read the fund's Key Investor Information Document and Prospectus prior to investment. These are available free of charge from Omnis Investments Limited. Omnis Investments Limited is authorised and regulated by the Financial Conduct Authority.