Why a diversified investment strategy is important

Download the 2022 assets table.

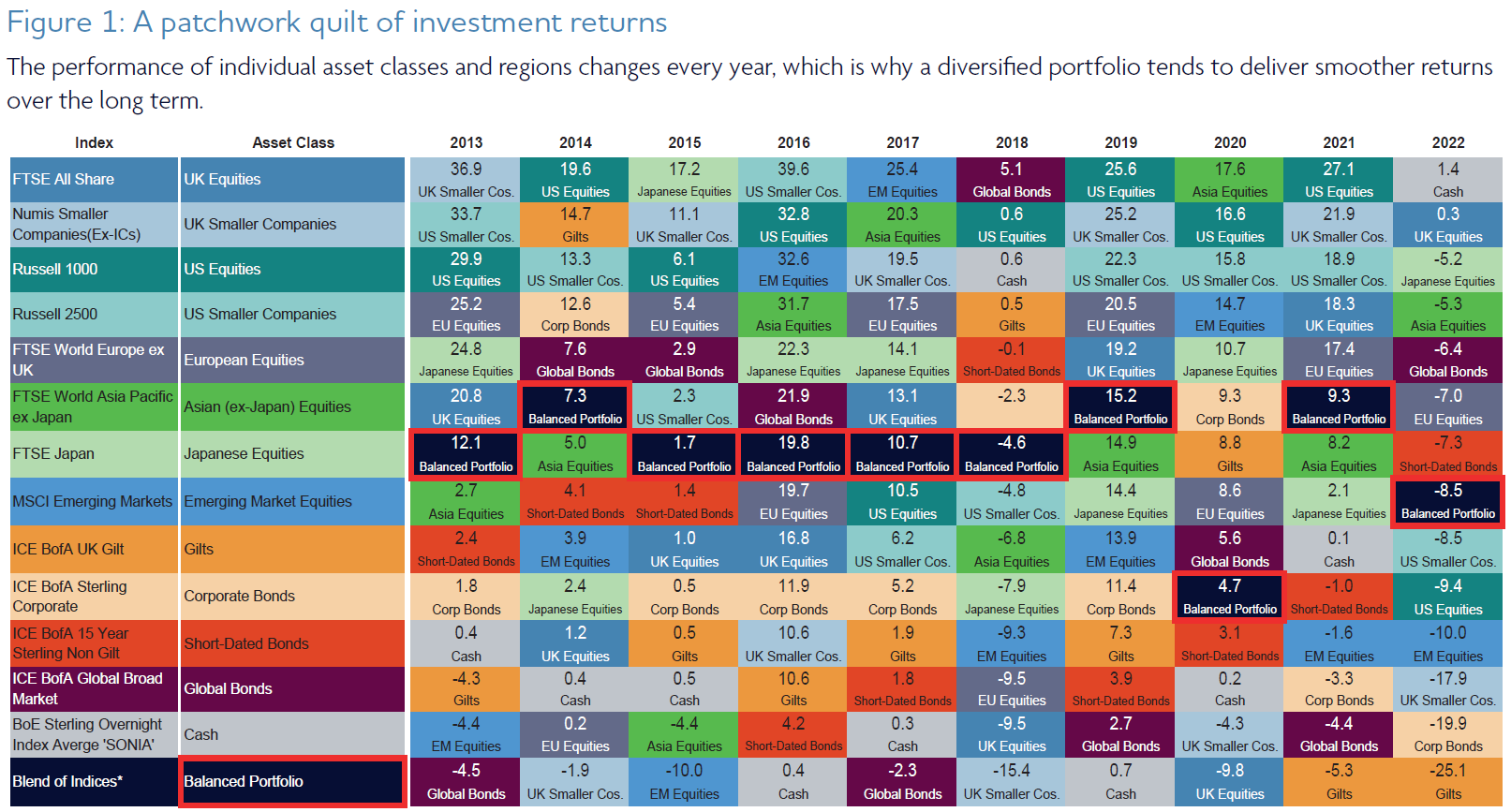

When you see cash as the best-performing asset class, you know it’s been a tough time for the markets over the past year. We take a look at how diversifying your portfolio can help reduce risk and smooth out returns over the long term.

Given the complexity of financial markets, predicting what will perform well is an incredibly difficult task. Markets are driven by a variety of factors, including economic developments, political events, investor sentiment and technological advancements. So even the most experienced investors and financial experts can struggle to accurately forecast how they will perform with much accuracy.

If you can’t predict the future then what do you do?

The asset allocation quilt (figure 1) shows us just how unpredictable markets can be. The chart ranks the performance of various popular asset classes over the past 10 years to show how different markets have performed. It gives us a comprehensive picture of the relative performance of different asset classes and regions on an annual basis.

For example, the FTSE All Share Index tracks the prices of companies listed on the London Stock Exchange’s main market. While it performed strongly with 20.8% growth in 2013, it’s also had years where it hasn’t done so well. For example, in 2014 the index rose by 1.2% and in 2018 it fell by 9.5%, placing it near the bottom of the rankings.

In comparison, a balanced portfolio sits around the middle of the chart for most years. This is because it’s designed to provide steady growth and limit losses by spreading your investment across a diversified portfolio of stocks and bonds. By investing in this way, balanced portfolios typically jump around less (have lower volatility) and therefore smoother performance over the long term.

*Balanced Portfolio uses Graphene C2 index equivalent, which is as follows: 28.5% FTSE All Share, 1.5% Numis Smaller Companies ex Investment Companies, 13.5% Russell 1000, 1.5% Russell 2500, 5% FTSE World Europe ex UK, 7% FTSE Japan, 3% FTSE World Asia Pacific ex Japan, 10% MSCI Emerging Markets, 14% ICE BoA UK Gilts All Stocks, 5% ICE BoA Global Broad Market, 6% ICE BoA Sterling Corporate, 1.25% ICE BofA 1-5 Year Sterling Non-Gilt, 3.75% SONIA GBP. Portfolio is rebalanced every six months In February and August. Source: FE fundinfo. All returns as at calendar year end in GBP.

Why it pays to diversify

One way to lower risk when investing is by spreading your wealth over a wider range of investments – known as diversification. By diversifying your portfolio you can reduce the risk that all of your investments will experience the same negative impact at the same time.

Assets or companies that are similar like Shell and BP are defined as positively correlated assets as they move in the same direction, while negatively correlated assets move in opposite directions. A diversified portfolio works best when you have investments that do different things at different times. For example, when shares go up, government bonds typically go down. When shares go down, bonds usually go up.

A mixture of both can offset losses and smooth out performance. When one part of a portfolio is struggling, another part can pick up the slack. History shows that a portfolio of investments that are diversified by asset class and global region is one of the best ways to grow wealth steadily.

Markets tend to go up in the long run, so it’s important to be patient and hold tight when there are any short-term fluctuations. Staying invested in a diversified portfolio can increase your chances of positive returns over the long term and achieving your financial objectives.

The proportion of the different asset classes in your portfolio is dictated by your attitude to risk. Your adviser will work with you to understand your objectives, capacity for loss and tolerance to risk. They will then be able to recommend a portfolio that is aligned to your needs.

If you have any questions about your investments, then please contact your financial adviser.